The COVID‑19 pandemic resulted in huge disruptions to the global supply chain, leading many businesses – including small and medium-sized enterprises (SMEs), the backbone of the world economy – to recalibrate their strategies and shift to a more sustainable approach.

The Hong Kong Trade Development Council (HKTDC) Research Department hosted a webinar recently to examine ways in which environmental, social and governance (ESG) financing solutions can help SMEs make their sustainability journey a more profitable one. The “Sustainable Finance for Hong Kong’s Post-COVID SMEs” webinar saw an HKTDC economist join with an HSBC executive to analyse how an ESG approach can help boost the corporate competitiveness of SMEs in the aftermath of the pandemic.

Boosting competitiveness

Climate change is impacting the whole world. Like other cities, Hong Kong is facing problems related to rising temperatures and the increased occurrence of extreme weather events.

In 2015, the United Nations adopted the 2030 Agenda for Sustainable Development with 17 sustainable development goals. The Paris Agreement – a legally binding international treaty aimed at reducing carbon emissions – seeks to limit global warming to between 1.5°C and 2°C before the close of this century. China’s 14th Five-Year Plan, meanwhile, supports Hong Kong’s development as a green financial centre, with particular emphasis on financing and certification for green projects in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA). This will generate new opportunities for the local business community.

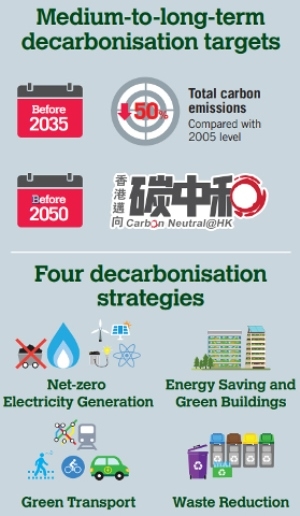

In order to mitigate rising temperatures, the Hong Kong Special Administrative Region (HKSAR) Government has adopted the Climate Action Plan 2050. This is an attempt to tackle the problem at source through net-zero electricity generation, energy-saving and green buildings, green transport and waste reduction. The government aims to reduce Hong Kong’s carbon dioxide emissions by 50% from their 2005 level before 2035, and to achieve carbon dioxide neutrality by 2050.

HK$240bn commitment

Nicholas Fu, Economist (Global Research) at HKTDC Research, outlined the government’s plans at the webinar.

“The government hopes to increase the share of renewable energy in the fuel mix for electricity generation to 15% from 7% at present. It also hopes to improve the energy efficiency of buildings by reducing the use of air-conditioning and lighting,” he said.

“Transport-wise, electric vehicles will be promoted with plans to prohibit the new registration of fossil-fuel propelled cars before 2030. Regarding waste reduction, generating energy from waste will be promoted to reduce environmental pollution,” Mr Fu said. In addition, the plastic shopping bag charging scheme will be enhanced, and the city’s people will be encouraged to use less plastic tableware.

The government has also set up the Steering Committee on Climate Change and Carbon Neutrality to put forward and promote policies designed to tackle climate change and strengthen education on the issue. A number of consultative committees have been set up to solicit public opinion. Technology innovation to improve energy efficiency and reduce carbon emissions is also being encouraged.

Indicating the level of investment being provided, Mr Fu said: “Hong Kong has pledged to invest HK$240 billion [US$30.6 billion] over the next 10 to 15 years to combat climate change. In addition to taxation, the government will also promote the development of green finance in both public and private sectors.”

Support for SMEs

Although ESG bonds and funds have multiplied in the past five years, Mr Fu noted that one crucial sector of the economy had failed to benefit, saying: “Most of these green funds end up in the hands of big businesses and relatively few SMEs are able to get a share of this pie.”

Pointing out that companies need technology innovation and funding support to pursue sustainability, he said: “According to a survey conducted earlier by the Hong Kong Productivity Council, 64% of SMEs said insufficient knowledge and funds are their biggest challenges when it comes to promoting ESG. Financial assistance, industry guidance and personnel training are what they need most.

Mr Fu explained that the Hong Kong Monetary Authority (HKMA) has set up the Green and Sustainable Finance Data Source Repository to help people in the financial sector search for data that can be used in climate risk management and other related analysis and research, as well as the Green and Sustainable Finance Grant Scheme to help SMEs apply for green loans more effectively.

The HKMA has also issued a Recognised External Reviewers List of 16 institutions to help SMEs obtain ratings and certifications. Under the scheme, the HKMA offers grants of up to HK$800,000 per loan to cover the cost of eligible expenses paid to recognised external reviewers. It has also substantially lowered the minimum loan size for the application of such grants from HK$200 million to HK$100 million in a bid to encourage more SMEs to apply for these grants.

ESG boosts competitiveness

Carrie Ng, HSBC’s Head of Sustainable Finance, Commercial Banking Hong Kong, noted that more and more Hong Kong businesses are ready to give ESG a try, explaining that there are three major reasons for this.

“Firstly, overseas buyers and companies are beginning to rate counterparties on their performance in environmental protection, social responsibility and corporate governance and will reduce, and even terminate, cooperation with business partners that have low ratings or underperform. Secondly, businesses understand that the use of energy-saving equipment can achieve significant cost savings and enable them to recoup investment faster. Thirdly, ESG helps improve companies’ corporate and brand image, while also winning the support of stakeholders and the public at large.”

Ms Ng added that ESG helps boost corporate competitiveness. There are all kinds of green finance products in the market. Green deposits and investment attract cash-rich companies, fuelling the rapid growth of the entire ESG ecosystem.

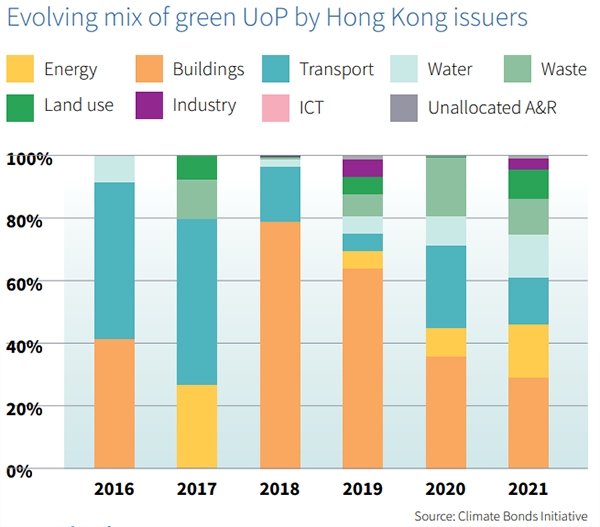

Pointing to one of the major trends in the development of green finance, Ms Ng said: “The fact that most companies that succeeded in applying for green loans last year were first-time applicants reflects that more companies are willing to tap into sustainable financing. Green loans were primarily for buildings or transport in the past, but now their use of proceeds (UoP) is increasingly diversified.”

Loan categories

Ms Ng said loans in this market mainly fall into two categories – “green loans” and “sustainability-linked loans”. The UoP of green loans is restricted to eligible green projects, such as sourcing eco-friendly raw materials, installing solar panels on the roof of factory premises to help save energy and reduce emissions, and switching to electric or hybrid vehicles to improve the performance of transport fleets.

Expanding on these loan types, Ms Ng said: “Companies need to bear three things in mind when they apply for green loans. Firstly, they must carry out project evaluation and selection. Secondly, they need to do a good job of proceeds management and must be able to track loan proceeds to ensure funds are allocated to eligible green projects. Thirdly, information disclosure. They need to report on the use of proceeds to lenders at least once a year.”

Sustainability-linked loans are more flexible and are suitable for general operational support. Before approving such loans, a bank typically first establishes with the borrower a number of sustainability-related key performance indicators (KPIs), such as carbon emissions, water consumption, occupational safety and staff training, and gender diversity at the management level. Ms Ng noted that the cost of these loans largely depends on how well companies do in terms of these indicators.

“The interest rate is linked to performance. The more KPIs that are achieved, the lower the repayment amount becomes. If none of the KPIs are met, the bank may raise the interest rate. The borrower must also do a good job of information disclosure and show its responsibility to stakeholders. It must also obtain third-party certification to ensure they meet the targets in different specific categories.”

GBA Sustainability Fund

HSBC launched its US$5 billion GBA Sustainability Fund in May 2022 to help businesses capture sustainable opportunities while transitioning to a low-carbon economy. The scheme covers sustainable finance solutions including green loans and sustainability linked loans. The proceeds must be used to finance sustainable projects that satisfy the use of proceeds pillar under the Asia-Pacific Loan Market Association’s Green Loan Principles. The eligibility of green projects is subject to external review by Sustainalytics.

The GBA Sustainability Fund, which runs for 18 months, is available to a wide spectrum of GBA-based companies of all sizes, including manufacturers and real-estate developers who engage in activities to lower their carbon dioxide emissions, and sectors covering climate change adaptation, pollution prevention, clean transportation, renewable energy, sustainable water resources and waste management.

As well as offering financing solutions, HSBC has provided additional support including ESG-related consultation services and personnel training to help companies maintain business growth.

Related links

HSBC

HKTDC Research