The rollout of the giant Regional Comprehensive Economic Partnership (RCEP), a new trade grouping that stretches from Japan on the fringes of the Arctic to New Zealand on the edge of the Antarctic, is driving optimism on long-term business prospects among enterprises in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

Businesses responding to the quarterly survey of over 1,000 companies operating in the GBA, conducted by Standard Chartered Bank (HK) Limited in collaboration with the Hong Kong Trade Development Council (HKTDC), fielded questions on the RCEP as well as the general business outlook.

Standard Chartered and the HKTDC used the survey results to compile their quarterly GBA Business Confidence Index (GBAI).

RCEP welcomed

Respondents said the RCEP, which incorporates fast-growing economies such as Mainland China and the Association of Southeast Asian Nations (ASEAN, main picture) and took effect at the beginning of this year, will impact the diverse group of GBA businesses. The prospect of removing 90% of tariffs and facilitating freer movement of factors of production among the free trade area’s member states appeared to be the perfect antidote to the many more economic, social and geopolitical uncertainties and challenges that GBA businesses are bound to face over the coming decade.

“The sheer size and diversity of the combined RCEP economies has the potential to reshape regional supply chains and boost their collective consumption and investment,” Kelvin Lau, Senior Economist, Greater China Standard Chartered Bank (HK) Limited, said. “The survey sought to find out whether respondents were optimistic on ways RCEP will help or change their business, and their plans to harness such potential.”

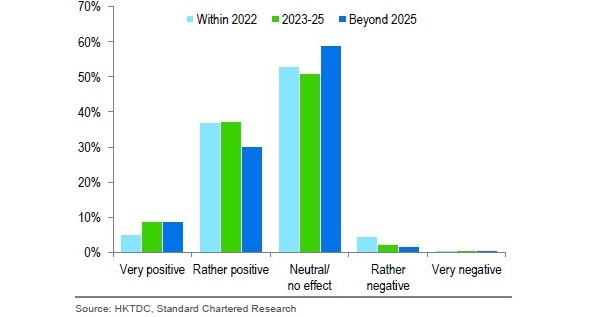

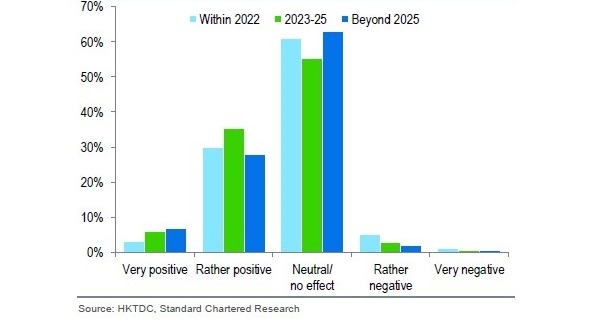

Respondents were asked to identity the RCEP’s impact across three timeframes – within 2022, between 2023 and 2025, and beyond 2025. A substantial 42.0% saw a very or somewhat positive impact on their business revenue, and 32.9% for investment, in 2022. These numbers further improved to 46.4% and 41.4%, respectively, for 2023-25, reflecting the perceived structural gains that come with time. Beyond 2025, however, some of the positive responses started to revert to neutral as early movers would have already reaped much of the RCEP’s benefits by then.

Economics of scale

A further breakdown showed that bigger companies have higher shares of positive responses, possibly reflecting the need for scale and capital to maximise the benefits from more cross-border trade, optimising supply chains, diversifying markets and making more investment. By industry, financial services appeared most optimistic on the RCEP’s impact on revenue this year, followed by professional services. Beyond 2022, however, innovation and technology (IT) saw the biggest jump to take the top spot for 2023-25, while retail and wholesale saw the least drop-off in positive responses beyond 2025.

In terms of lifting investment, IT and manufacturing respondents appeared most optimistic in 2022, before being surpassed by retailers and wholesalers as well as those in financial services. These results showed the RCEP is not just about benefiting manufacturing and trading, but also the various services sectors that facilitate cross-border trade and gaining access to new markets.

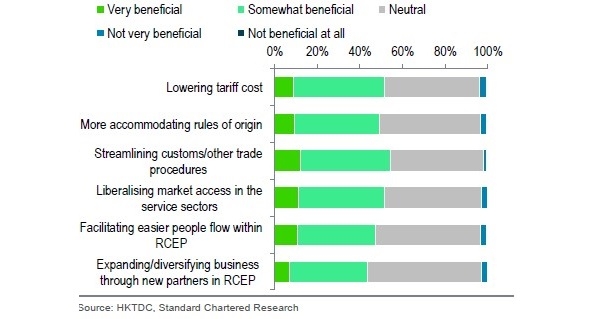

Unsurprisingly, “streamlining customs and other trade procedures” and “lowering tariff cost” were leading reasons for welcoming the RCEP. More encouragingly, 51.3% of respondents also associated their business outlook positively to the RCEP’s ability to grant new market access to services sectors among member states. Other options, including more relaxed rules of origin (49.0%), easier people flow within the RCEP (47.3%), and greater access to new business partners in other member states (43.5%), all had more than 40% positive votes, suggesting strong awareness of the RCEP’s wide-ranging benefits among the diverse respondents.

Immediate relief

Asked how the RCEP could help alleviate some of the more immediate stresses on businesses, the trade pact’s ability to reduce the impact from “supply chain disruptions” and “COVID-19 pandemic” had the most net-positive results, at positive 6.8 points and 6.7 points, respectively. “Rising costs” also had a net positive of 2.7 points, while “US-China tensions” had a net negative 1.9 points.

“We, however, believe that these challenges – be it COVID disruptions, geopolitical tensions, or worsening costs – all lead back to the need for production and market diversification, which in turn will continue to be a key driving force for much closer intra-Asia trade and investment integration, and the RCEP’s role in accelerating this transformation will likely be appreciated over time,” Mr Lau said.

On transformation of the business environment over the next one to three years, 46.1% of respondents expect the RCEP to change their trade and supply chain models by (either significantly or slightly) increasing their sourcing of goods/services from RCEP economies; 44.7% said they would export more goods and services to RCEP member states; and 29.0% starting more production and/or investment there.

Asked how they see the scale of their business activity in or with RCEP member countries change in the coming one to three years, most respondents (53.6%) expected Mainland China to lead the way, followed by ASEAN’s 26.4%, and Japan’s 24.9%. The mainland had the most positive responses for “manufacturing and trading”, “professional services” and “innovation and technology” from respondents, while the more developed RCEP economies (Japan, Korea, Australia and New Zealand) were the opposite, doing better among their “financial services” and “retail and wholesale” respondents. ASEAN, in contrast, had the least diverse range of responses among industry groups.

Below neutral

Broad business confidence weakened for a third consecutive quarter in January to March but is expected to improve in the second quarter. The GBAI’s “current performance” index for business activity fell to 49.6 – the first time to dip below the neutral 50 mark since the third quarter of 2020 – from 50.3 in October to December last year.

“This partly reflected headwinds from the second half of 2021, when the mainland housing market slowed, COVID-19 pandemic disruptions lingered and regulations on tech companies were tightened,” Mr Lau said. “Policy easing probably helped limit the headline drop this time as our credit indices did see better bank appetite to lend; but that alone was not enough to offset Hong Kong’s sizeable drag as the city battled (and is still battling) its worst COVID wave so far.”

A further breakdown showed the “current performance” indices for the services sectors underperforming those for manufacturing and trading, which in turn explains the more modest readings for Shenzhen and Guangzhou compared with, say, Dongguan and Foshan, Mr Lau explained.

“In comparison, the latest rebound in the more forward-looking ‘expectations’ indices – with the headline rising to 55.5 in Q1 from 53.6 prior – appears much more broad-based; however, note that these numbers have yet to fully reflect newer headwinds such as the COVID resurgence and escalation in the Russia-Ukraine conflict, both of which only started being captured towards the tail end of our survey period.”

Related link

GBAI