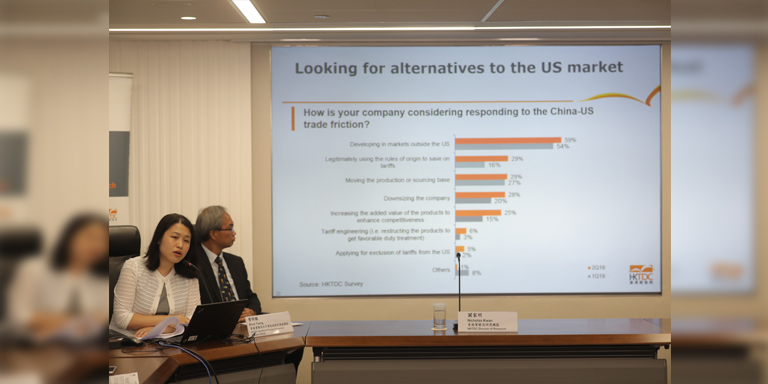

In response to trade friction between Mainland China and the United States, exporters in Hong Kong are proactively finding their way out, Hong Kong Trade Development Council Director of Research Nicholas Kwan said when announcing the HKTDC’s latest export outlook.Exporters’ most widely adopted approach is market diversification, with 58.6% of respondents considering developing “markets outside the US”. Other strategies that have shown substantial growth include “using the rules of origin to shift the official origin of a product” (29.3%), “downsizing the company” (27.6%) and “increasing the added value of the products to enhance competitiveness” (25.4%).The threat posed by prolonged trade disruption and slowing growth in some of the world’s major economies led the HKTDC to revise its forecast for Hong Kong’s export growth in 2019 to 2% from 5% previously. Exporters have been more proactive in diversifying their markets and enhancing product competitiveness.“Escalating trade tensions and heightened geo-political uncertainties have severely dampened Hong Kong’s export growth momentum, raising the urgency for local business to further diversify operations and markets,” Mr Kwan said at a press conference. “More local exporters are developing markets outside the US or manufacturing their products in places that are not affected by additional US tariffs.”Last month, the US threatened to impose tariffs on an additional US$325 billion worth of goods from the mainland, which effectively would mean all remaining products.“The escalation of the Sino-US trade dispute will undermine the economic growth of both the US and the mainland, as well as other countries connected through the supply chain network,” Mr Kwan added. “Protectionism remains the biggest threat to Hong Kong’s export outlook.” According to the HKTDC’s latest study, more than 40% of the local exporters surveyed had been negatively affected by the current trade friction, with shrinking order sizes (52.4%) and price bargaining (39.9%) the most common consequences. Also 36.1% of respondents said they had shifted sourcing away from the mainland.

Export Index edges down to 37.3

In addition to the slowing growth forecast, the HKTDC Export Index edged down 1.9 points to 37.3 in the second quarter of 2019. “Hong Kong exporters have turned more pessimistic across all major sectors and markets,” HKTDC Assistant Principal Economist (Greater China) Alice Tsang said. The HKTDC Export Index gauges near-term export prospects. Readings above and below 50 indicate positive and negative sentiment respectively.

Ms Tsang noted that the indices remained in contractionary territory for the fourth consecutive quarter, “but the relatively small drop suggested that the pessimistic sentiment is somewhat stabilised”.Exporters in major sectors are more cautious than in the previous quarter, she said. Machinery is the most positively rated sector, with a score of 38.9 points, followed by jewellery (38.2) and electronics (37.8), while toys exhibited the largest drop in confidence, with the reading plunging 9.4 points to 32. As for the prospects for specific markets, Japan (49.6) and the mainland (47.4) elicited a degree of optimism, while exporters were less confident about the growth potential of markets in the European Union (46.8) and US (42.7).

STEM toys gain popularity in mainland

As the spending power of mainland consumers has risen, parents have begun to view toys as an indispensable part of a child’s development, providing fresh opportunities for Hong Kong manufacturers. Incorporating STEM (science, technology, engineering and mathematics) elements or new technologies into products will help enhance the appeal of the toys to parents, who have the final say in deciding which toys to purchase.Speaking at the export press conference, HKTDC Economist Poon Cheuk-hong said that according to the latest mainland toy consumption survey conducted by the HKTDC, mainland parents spent an average of Rmb2,596 (US$375) in the past 12 months on buying toys – an increase of 143% compared to 2014. Their main motivation in buying toys is to build their children’s abilities and enhance their intelligence, and Mr Poon said parents are willing to pay more for quality educational toys that integrate learning and recreation.“STEM toys encourage children to acquire scientific knowledge through problem-solving and can supplement their school studies, which is why they are much sought after by parents,” Mr Poon explained. The study also found that 98% of the mainland parents surveyed had bought or were interested in buying STEM toys, while 90% agreed that new-tech toys (those with artificial intelligence, virtual reality and augmented reality elements, or drones) are more interesting than other toy products. He added that safety (24%) is the top consideration when parents make decisions to purchase toys. Other key factors include “suitability for the child’s age group” (14%), “international certification” (11%) and “enhancement of the child’s knowledge” (10%). The survey was conducted from October to December 2018 with some 2,000 respondents completing the online questionnaire.

Related links

HKMB US Trade Page

HKTDC Research