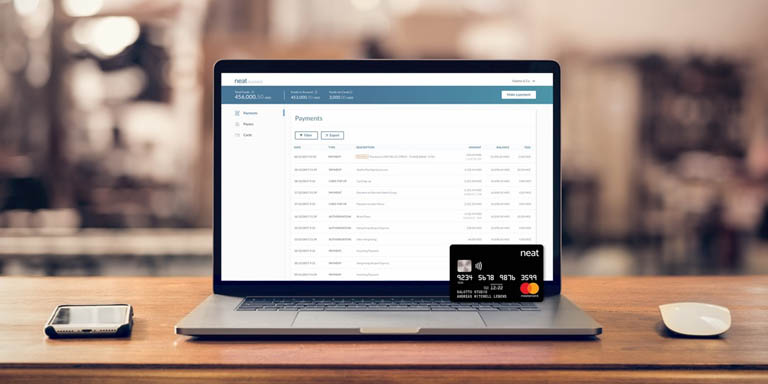

When you are looking to build a disruptive business, start from the premise of solving a “pain point” experienced by users of traditional players in that sector – so says Hong Kong-based entrepreneur David Rosa, co-founder of local financial services disruptor Neat, who did not have to look further than the banking sector.After discovering that start-ups and small and medium-sized enterprises (SMEs) in the city are largely underserved by traditional banks, ex-Citi banker Mr Rosa and Hong Kong-based technology entrepreneur Igor Wos teamed up to create a solution that would fill that gap.Mr Rosa describes Neat – which cannot be called a bank because of regulatory requirements – as an alternative to a traditional bank account.“Neat is a purely digital solution where (approved) customers can easily and remotely open an account, with everything done online,” he said.Neat, established in 2015, says it has customers hailing from 100 countries. Mr Rosa did not disclose the numbers but said the company is “well on track to get to 10,000 business customers by [the first quarter of] 2019”. “Currently,” he said, “we are growing at a monthly rate of 30 to 50%”.The first offering was a consumer product but Neat soon noticed a greater need for “financial inclusion” in the start-up community.“It’s a space the banks have chosen not to play in, and we’re making a run for it,” Mr Rosa said.He explained how Neat addresses the “pain points” small-business customers may encounter in trying to open a bank account in Hong Kong.“Our digital-only solution provides SMEs with a current account accessed remotely to receive and pay money globally, as well as a debit MasterCard, through a very robust infrastructure,” Mr Rosa said. “The Hong Kong Government has given Neat two patents on our methods and payments, and we are the only financial institution compliant for KYC [know your customer] requirements for both individuals and companies.”Successful applicants did not need to pay fees to maintain a Neat account and there is no minimum balance, he said.

All payments are pushed and reconciled through Xero accounting software, which is a “huge time saver” in terms of SMEs’ bookkeeping. A new service for entrepreneurs, aimed at bringing more businesses to Hong Kong, bundles company incorporation with a Neat business account. “You only have to provide the information once and the whole process takes 10 minutes,” Mr Rosa said.The founders had applied for a virtual banking licence but have since withdrawn the application as they found the process prohibitively expensive. “The minimum capital requirement is HK$300 million [US$38 million], which raises the cost infrastructure of a virtual bank to the extent that it prices itself out of real financial inclusion,” Mr Rosa said. “In the European Union, you’d need only €5 million [US$5.7 million].”The company operates on investor funding and a “float” of customer deposits. Under the same licensing as the Octopus stored value system, the float is put into a trust account daily via Neat’s banking partner, the Industrial and Commercial Bank of China.In October 2018, Neat secured its second round of investor funding, bringing the year’s total to US$5 million. Linear Capital, a venture capital (VC) firm based out of Shanghai, led the latest US$3 million investment round, joining existing investors Dymon Asia Ventures, Portag3 Ventures and Hong Kong-based Sagamore Investments. “With this new investment, we’re ready to take on the [Mainland] Chinese market,” said Mr Rosa. “Today we are seeing more young enterprises from China venturing beyond their domestic market and we are excited to make our Neat Business product available to them.”He added that Hong Kong “is a logical choice for [Mainland] Chinese companies to set up and launch their international trading, and we believe we are well positioned to support these entrepreneurs in growing their international business”.“We will use the new capital injection to focus on accelerating the release of new product features, attracting further talent to the team and getting our product ready for the Chinese market,” Mr Rosa said. “Neat will also be leveraging Linear Capital’s expertise in data science to build a truly data-driven business, as well as tapping into the VC’s deep expertise and wide network in the China market.”Where to from here? “Growth, growth and more growth,” Mr Rosa responded. “We are in the process of opening a Shenzhen office now.” With 70% of Neat customers involved in e-commerce – purchasing goods made in the mainland to sell via the Internet – having a true foot in the mainland market would help, Mr Rosa said.The Hong Kong Trade Development Council will hold the Asian Financial Forum on 14 to 15 Jan. Finance and banking technology will be one of the key issues under discussion.

Related Link

Neat