The Guangdong‑Hong Kong‑Macao Greater Bay Area is making great efforts to build an international technology and innovation centre as well as developing into an innovation‑driven economy. According to the Greater Bay Area Startup Ecosystem White Paper published by Hong Kong start‑up community and power connector WHub, as of 2019 the Greater Bay Area was home to 43 unicorn companies engaged mainly in e‑commerce, health technology, robotics, financial technology and biotechnology, worth a combined US$1.1 trillion.

The Global Innovation Index 2020 ranked the Guangzhou‑Shenzhen‑Hong Kong science and technology cluster – formed by the innovation and technology industries in the three cities – second in the world, trailing only the Tokyo‑Yokohama science and technology cluster. The Greater Bay Area’s innovation achievements and its direction of development mean that it is undoubtedly one of the major markets for Hong Kong start‑ups seeking outward expansion.

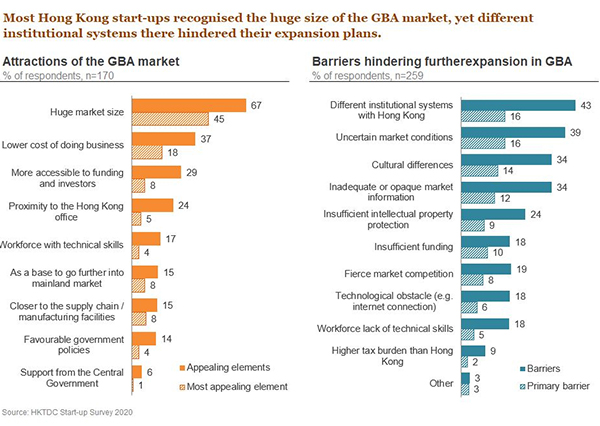

HKTDC Research conducted a questionnaire survey and in‑depth interviews with local start‑ups in mid‑2020. The aim was to achieve a better understanding of the development and performance of the domestic start‑up ecosystem, and also to identify growth opportunities available in the Greater Bay Area. The survey found that local start‑ups find the huge market size and lower cost of doing business in the Greater Bay Area appealing.

Nearly half of the respondents said they were interested in expanding into the Greater Bay Area market. Different institutional systems in Greater Bay Area cities in Mainland China and the uncertain market conditions there have exacerbated the difficulties Hong Kong start‑ups face when they try to enter this market. However, opportunities still exist for them in the Greater Bay Area depending on the nature of their business, with start‑ups whose activities are in line with the directions of the Greater Bay Area’s overall development poised to benefit.

Huge market

The survey found that 20% of the respondents have set up offices in mainland Greater Bay Area cities. Of those 71% that had done so had chosen Shenzhen (main picture) and 22% had opted for Guangzhou. Other mainland Greater Bay Area cities, however, had not proved to be so popular. Of all respondents, 34% have business operations within the Greater Bay Area, mostly in research and development and some in sales and sourcing activities, while 43% expressed their interest in expanding further into the Greater Bay Area market, and 38% were in the process of identifying business partners there.

The survey looked into the factors attracting Hong Kong start‑ups to venture into the Greater Bay Area. Among those that have already entered the Greater Bay Area market (eg opened offices, started business operations, or participated in study missions there), 67% recognised the huge consumer market there, with 45% of them saying this was the most appealing element of the Greater Bay Area. At the company interviews, a number of start‑ups pointed out that the small size of the Hong Kong market has hindered the growth of their business to some extent, and because of this, they have ventured into markets outside Hong Kong. As well as looking towards traditional European and American markets and emerging ASEAN markets, they have also turned to the Greater Bay Area.

When asked about the difficulties and challenges they face, 37% of the local start‑ups replied that the rising cost of doing business in Hong Kong has made it more difficult for them. This is another major reason given by them for expanding into the Greater Bay Area, with 37% of the respondents pointing out that the cost of doing business in the Greater Bay Area is lower. Of the respondents, 18% said that the cost factor is even more important than market size as a reason to expand into the Greater Bay Area. Some respondents also highlighted a greater access to funding and investors (29%), proximity to their Hong Kong office (24%), and the presence of a workforce with a higher level of technical skills (17%) as important attractions of the Greater Bay Area.

Different business environments

Lured by factors like the huge market size and the lower cost of doing business, nearly half of the respondents expressed their interest in expanding further into the Greater Bay Area market. Yet the survey found that only about one‑third of the start‑up companies have business operations there. Of the respondents, 43% said that the different institutional systems (eg tax, legal) there hindered their expansion plans. As Hong Kong companies have to devote extra resources to understanding and aligning with mainland business practices and work-flows, start‑ups are often put off because they do not have enough resources to do so.

Of the respondents, 39% were also concerned about uncertain market conditions. During the company interviews, it became clear that some local start‑ups believe that mainland government policies are unpredictable and subject to change overnight, which explained why they were not too keen about developing their business in the Greater Bay Area. Moreover, local start‑ups moving into the Greater Bay Area have to deal with cultural differences, which not only affect their daily communications with mainland customers and staff, but also their ways and means of doing business. For instance, one of the difficulties encountered by many companies when marketing in the mainland is access to social media. Facebook and Instagram are widely used in Hong Kong while WeChat and Xiaohongshu are the common marketing channels in the mainland. Another barrier to doing business in the Greater Bay Area market mentioned by 34% of the respondents is opaque market information, which increases the worry of Hong Kong start‑ups about the lack of certainty of market conditions in the mainland.

When asked about the performance of Hong Kong’s start‑up ecosystem, the respondents were in general more satisfied with Hong Kong’s connections with overseas markets than with the access it provides to the mainland market. However, when interpreting the survey findings, it should be noted that the survey was conducted between June and July 2020, and that global developments such as United States‑Mainland China trade friction and the COVID‑19 pandemic may have had an impact on the views of the respondents.

Start-up needs not met

In the past two years, the Hong Kong government has been working hard to help local start‑ups, especially young entrepreneurs, venture into the Greater Bay Area. Existing policies encouraging young people from Hong Kong to innovate and start businesses in the Greater Bay Area include:

In March 2019, the Youth Development Commission rolled out the Funding Scheme for Youth Entrepreneurship in the Guangdong-Hong Kong-Macao Greater Bay Area and Funding Scheme for Experiential Programmes at Innovation and Entrepreneurial Bases in the Guangdong-Hong Kong-Macao Greater Bay Area under the Youth Development Fund. These two schemes aim to finance Hong Kong non-government organisations providing entrepreneurial support and incubation services for young people starting a business in Hong Kong and mainland Greater Bay Area cities.

The 2019 Policy Address announced that an Alliance of Hong Kong Youth Innovative and Entrepreneurial Bases in the Greater Bay Area would be established and organisations from Guangdong and Hong Kong, such as innovative and entrepreneurial bases, universities, non-government organisations, scientific research institutes, professional bodies and venture funds, would be invited to join the alliance and jointly set up a one-stop information, publicity and exchange platform.

In addition to this, the Central Government in Beijing promulgated 16 policy measures in November 2019 to support the establishment of the Greater Bay Area. In the innovation and technology sector, steps would be taken to support the development of the Shenzhen-Hong Kong Innovation and Technology Co-operation Zone, facilitate customs clearance of imported animal‑derived biomaterials, and relax the limitation on exporting mainland human genetic resources to Hong Kong and Macao.

Nevertheless, when the respondents were asked about the elements attracting Hong Kong start‑ups to establish a foothold in the Greater Bay Area, only 14% named favourable government policies available in the market there as an attraction. This suggests that there may currently be a mismatch between the needs of start‑ups and government policies. To Hong Kong start‑ups, the integration of institutional systems in Guangdong, Hong Kong and Macao is more important than monetary support. In view of this, mainland Greater Bay Area cities should be putting more effort into integrating the different institutional systems and explaining the differences to businesses. This would help to attract Hong Kong start‑ups to expand further into the Greater Bay Area and promote the growth of the start‑up ecosystem across the entire area. At the same time, the Hong Kong government should help local start‑ups gain a better understanding of the business environment in the Greater Bay Area and provide more transparent market information so that businesses can become more confident about making a foray into the Greater Bay Area.

Business type decisive factor

Although Hong Kong start‑ups encounter a number of barriers when trying to begin operating in the Greater Bay Area, the survey found that opportunities still exist in the Greater Bay Area for different industries. According to the findings of the questionnaire and the information obtained from the company interviews, the following types of start‑ups have obvious advantages when looking to develop the Greater Bay Area market:

Conform to Greater Bay Area development directions

One example of an industry aligned with the Greater Bay Area’s development is biotechnology and healthcare. As the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area states that emphasis is to be placed on growing the healthcare sector, Hong Kong companies in this sector looking to expand into the mainland market stand to benefit. However, the sector is subject to close supervision by the mainland government, so whether industry players can capture the opportunities available in the Greater Bay Area really depends on the integration of institutional systems between Guangdong and Hong Kong. Lydia Leung, CEO of Beluntech, pointed out that the Hong Kong Medical and Healthcare Device Industries Association (HKMHDIA) has lobbied the Hong Kong government to negotiate with the Greater Bay Area on integrating the relevant rules and regulations of the two places so that any future medical device regulations can apply to both the mainland and Hong Kong.

Businesses subject to mainland import regulations

These companies are advised to set up factories in mainland Greater Bay Area cities as a base for entering the mainland market. For instance, Gordon Tam, founder of Farm66 Investment, contacted the Hengqin Science & Technology Industrial Park in Zhuhai through Hong Kong’s Cyberport, and was subsequently invited by the Hengqin government to set up an indoor aquaponics farming plant there. The newly reorganised Hengqin Science & Technology Industrial Park is very attractive to Hong Kong start‑ups as it offers a complete range of support facilities such as logistics and town planning, as well as various preferential policies, including government 1:1 match funding. By setting up an aquaponics farm in Hengqin, the vegetables grown indoors by Farm66 will be able to be supplied directly to the mainland domestic market.

Hong Kong start‑ups in other sectors, however, may not regard the advantages of developing their business in the Greater Bay Area as being very prominent. Take information technology for example. Start‑ups in this industry wanting to tap into the Greater Bay Area market need to inject a great deal of money and resources into developing a system that is compatible with and can be applied in mainland cities. Patrick Tu, co‑founder and CEO of Dayta AI, a local start‑up focusing on artificial intelligence application, said his company has no plans to venture into the Greater Bay Area market for the time being because their streaming technology is not supported on the mainland.

In conclusion, a company’s ability to exploit opportunities in the Greater Bay Area depends largely on the nature of its business. With this in mind, Hong Kong start‑ups should constantly try to keep abreast of development trends in the Greater Bay Area. If the trends are suitable, then the Greater Bay Area, given its huge market size, can undoubtedly be a major market for Hong Kong start‑ups seeking outward expansion. Businesses can also take full advantage of the advantages available in the Greater Bay Area, such as the lower cost of doing business, sufficient human resources and better technical skills, to boost their growth.

Related links

WHub

HKTDC Research